Manual payment processing worked when your business had three customers and a landline. Now, juggling dozens of payment methods and currencies with sticky notes and spreadsheets is just a bad joke.

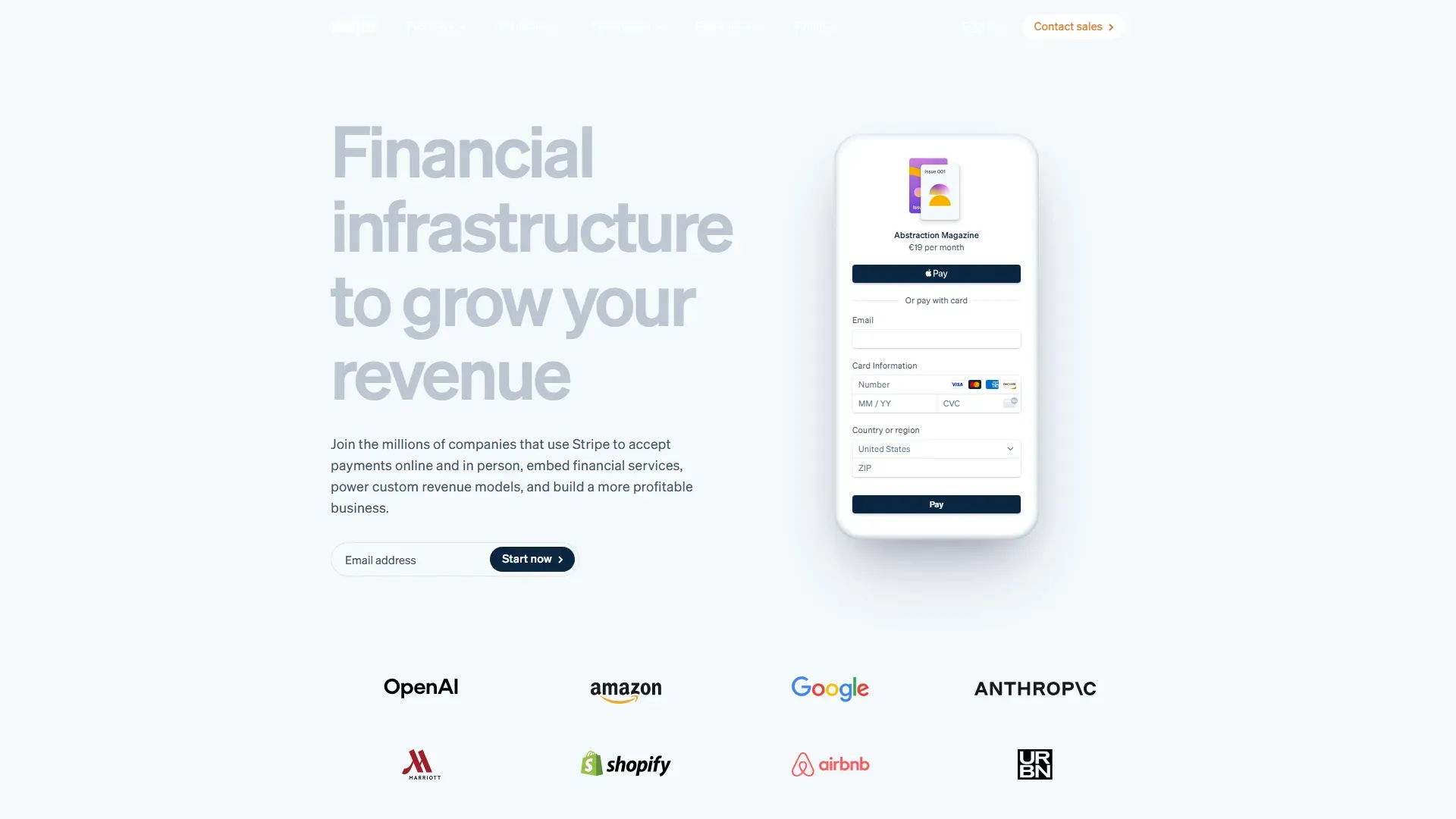

Stripe breaks that old rule with a sleek suite of APIs designed for the modern online business. From startups to enterprises, Stripe streamlines accepting payments globally and automates revenue operations with a developer-friendly touch.

With AI-powered fraud detection, flexible subscription billing, and customizable payment forms, Stripe is built to boost your conversion rates and keep fraudsters at bay without slowing down your cash flow.

Its global reach covers over 135 currencies and local acquiring in more than 47 countries, so you can sell anywhere without the headache of international payments.

In 2024, Stripe processed over $1.4 trillion in payments for businesses around the world. To put that into perspective, that's equivalent to roughly 1.3% of the entire world's GDP.

Need embedded finance features like issuing cards or lending? Stripe's got you covered, integrating financial services directly into your product.

For creators and marketplaces, Stripe simplifies onboarding and payouts worldwide with prebuilt UI options, letting you scale without the usual friction.

The result? Less manual chaos, more predictable revenue, and a payments system that actually keeps up with your business - not the other way around.

Stripe is perfect for ambitious online entrepreneurs who want to innovate and grow revenue fast, without drowning in payment complexities.

Best features:

- AI-powered fraud prevention for safer transactions

- Flexible billing options supporting subscriptions and usage-based revenue

- Customizable payment forms that increase conversion rates

- Global payment support with 135+ currencies and local acquiring in 47+ countries

- Embedded finance tools enabling in-product cards and lending

- Developer-friendly APIs and no-code solutions for quick deployment

Stop wrestling with payments and let Stripe scale your revenue with sleek, global-ready APIs.

Use cases:

- E-commerce stores expanding internationally

- SaaS providers managing recurring subscriptions

- Marketplaces onboarding global sellers and buyers

- Online creators managing payouts and monetization

- Startups needing rapid payment system deployment

- Enterprises automating revenue operations and tax compliance

Suited for:

Online businesses of all sizes seeking scalable, secure payment infrastructure that reduces manual effort and boosts revenue.

Integrations:

Supports integrations with Shopify, WooCommerce, Salesforce, Xero, QuickBooks, and over 100 other platforms