Forget the old school idea that payments should be a hassle only IT gurus can handle. Mollie throws that rule out the window and makes payment processing as easy as ordering your favorite coffee.

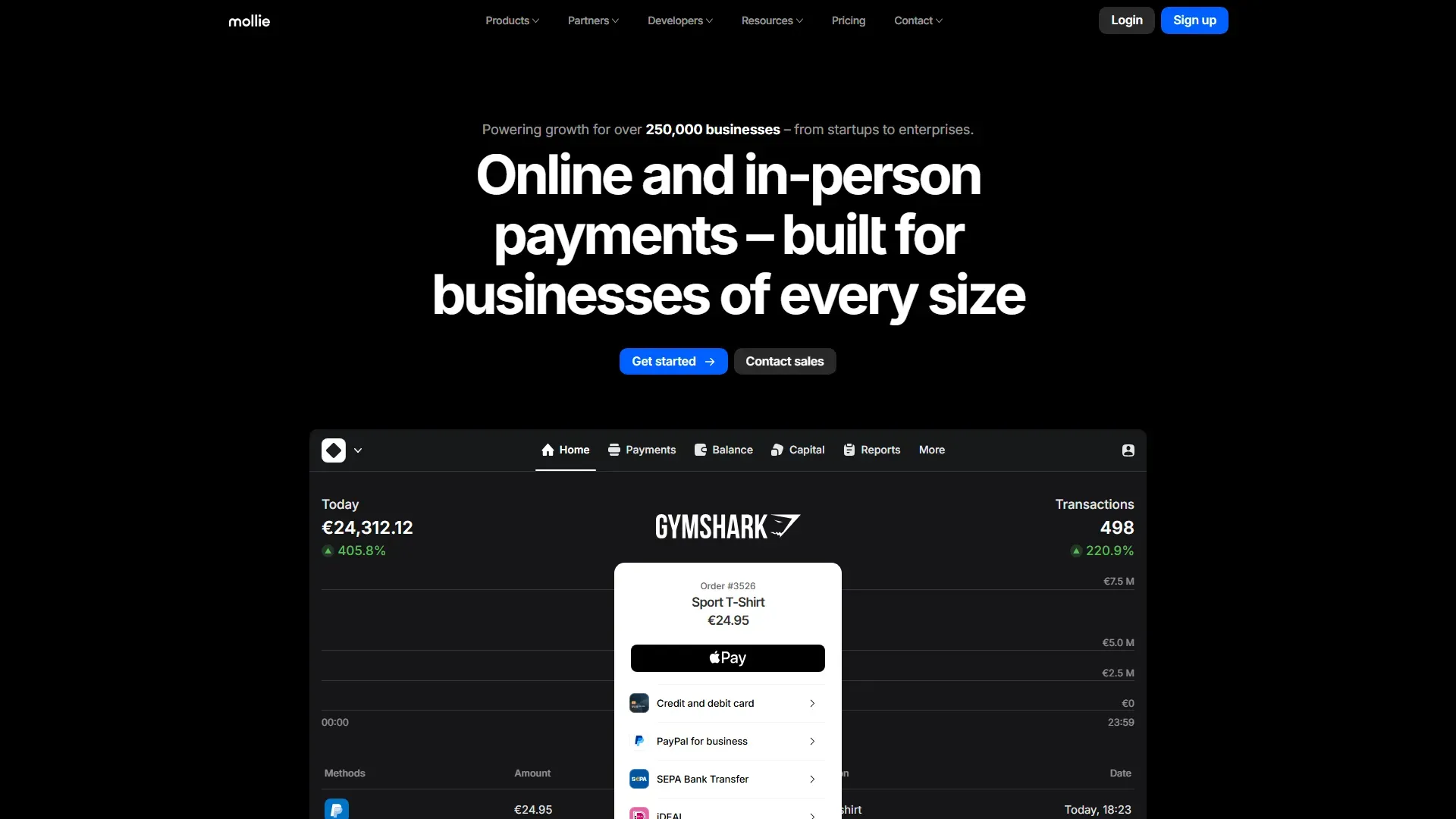

With Mollie, you get a streamlined payments platform designed for businesses of all sizes - from fresh startups to enterprise giants. It handles online and in-person payments with quick setup and zero drama. Customize checkout pages, send secure payment links, and manage subscriptions effortlessly.

Not tech-savvy? No problem. Mollie integrates seamlessly with your e-commerce platform or marketplace, thanks to its rich developer tools and prebuilt connections. Tap to Pay on iPhone or flexible terminals get you selling face-to-face faster than you can say “approved.”

The platform also comes with fraud prevention tools, reducing chargebacks and protecting your revenue without slowing you down. And its unified dashboard brings all your payments, cash flow, and accounting insights into one place, saving you time and headaches.

Choose from multiple payment methods that your customers actually want, like credit cards, PayPal, iDEAL, and Klarna - boosting conversions across Europe and beyond.

Mollie is perfect when you want payments to work smoothly, so you can focus on scaling your business, not wrestling with transactions.

Best features:

- Quick setup for faster sales and growth

- Seamless integration with popular e-commerce platforms and marketplaces

- Flexible payment options tailored to diverse customer preferences

- Unified dashboard for easy financial management and insights

- Built-in fraud prevention reducing chargebacks and protecting revenue

- Supports both online and in-person contactless payments

Stop wrestling with payment headaches and get Mollie to turn transactions into smooth business fuel.

Use cases:

- Startups needing quick and easy payment setup

- Online stores looking to increase checkout conversion rates

- Brick-and-mortar shops wanting smooth contactless payment options

- Subscription businesses managing recurring billing

- Enterprises requiring detailed payment analytics and risk management

- SaaS companies integrating payments with existing platforms

Suited for:

Online and physical businesses of all sizes seeking reliable, secure, and user-friendly payment solutions to boost sales and streamline financial operations.

Integrations:

E-commerce platforms, SaaS tools, marketplaces, iOS Tap to Pay